The morning of August 2nd, 2024, I published the following letter to Limited Partners of Asheville Capital Management. It is reproduced here for your benefit. Nothing written herein is investment advice.

2024 Asheville Capital Interim Letter

Dear Partners,

In the first half of 2024 Asheville Capital’s returns were -10.9% while our primary benchmark, the MSCI ACWI produced 11.4% returns. In May we passed the two-year mark since the inception of the Asheville Capital Management portfolio. As you will see in the table below, these two years have been bookended by two periods of underperformance with an intermediate period of outperformance. While cumulative results at the end of 2023 were 16.5%, the most recent six-month drawdown to the portfolio has resulted in a 3.4% cumulative return for the portfolio. This compares highly unfavorably with our benchmark which is up 32.7% over this period.

There is no sugar-coating the fact that we have underperformed our benchmark by a country mile in a short period of time. Despite having produced 23.4% returns in 2023, on the back of a -5.6% performance in 2022, the portfolio has contracted in value over the last six months while the ACWI has posted gains, thus widening the gap considerably between ourselves and the index.

Our high exposure to Japan was the leading reason for underperformance during the first half of the year. Our two investments in this country, Raksul and Medley, declined in value by 25% and 18%, respectively as part of a broad-based sell off of Japanese growth companies during the period. Neither of these companies reported negative news; quite the contrary actually with positive earnings reports and upgrades to guidance. Our theses in these businesses are moving along nicely despite their multiples having contracted significantly. We have therefore been opportunistic in adding to these positions at these lowered levels.

But there was a double-whammy of sorts given that we measure our returns in US Dollars and the Japanese Yen’s value relative to USD decreased by 14% over this same time period, sinking to its lowest conversion rate since December of 1986, a 38-year low. Thus, the USD-equivalent value of our shareholdings in Raksul and Medley decreased by 35% and 29%, respectively. This, as well as our short-lived investment in Bleach, in January, (written about in our Q1 update) accounts for more than 90% of our contributed losses in the first half of the year.

Fortunately, there is a bit of good news to share. Through July, the portfolio has appreciated by 10% in value while the ACWI is up 2%, thus closing the gap between us and our benchmark by 8% and bringing cumulative returns up to 14% in only one month. Still, if I am going to make the case that two-years of data is an insufficient period to determine stock-picking skill (or a potential lack thereof) then a few weeks of data should be taken with a proportionally large grain of salt.

You may remember from our 2023 Annual Letter that I wrote to you, “In any twelve-month period going forward, we are likely to experience severe bouts of volatility. The concentrated nature of this portfolio, combined with the fact that we invest exclusively in the ugly ducklings of today’s quantitative data, makes it such that we will experience volatility at a greater rate than that of public equity indices, which are themselves an already volatile asset class.”

Of the 25-months since the inception of the Asheville Capital portfolio, only five of these months have returned less than ±1%, while fourteen have seen a ±5% return or greater! We have indeed experienced severe volatility and will continue to do so with violent swings both to the positive and to the negative. The most recent six-month period of volatility has been sickeningly experienced on the negative side, but I remain confident that positive volatility lies ahead.

My confidence rests on the age-old Ben Graham quote, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Our investments today will not win many popularity contests. But each of them operate with compelling value propositions and sustainable competitive advantages that are allowing them to grow steadily and cost effectively within industries that are many multiples of their existing size. Therefore, in the long-run, the earnings of our businesses will speak for themselves. As long as we have paid a fair multiple for those future earnings then we will make out well.

Portfolio High-Level

The Asheville Capital Portfolio is fully invested into nine companies across Japan, Europe, Australia, and China. Our European businesses are headquartered in the UK, Poland, Netherlands, and Sweden, but each of these has significant pan-European or global revenue exposure. Our highest country-specific risk is in Japan, where 26% of our assets are located across two positions, the aforementioned Raksul and Medley.

As far as industry exposure is concerned, our highest degree of exposure is to consumer discretionary, with Temple & Webster and InPost depending on e-commerce purchases for their revenues, as well as Wise (a new addition to the portfolio) being reliant to a certain extent upon travel. Meanwhile, we own one consumer staple in auto parts distribution (Auto Partner) and one borderline staple in low-cost fitness (Basic-Fit). We also have exposure to Japanese small-business advertising (Raksul) and healthcare operations (Medley). Our most cyclical business is in podcast advertising, with Acast. And finally, we own one true technology company (Agora) that is exposed to venture capital-backed technology companies as its primary clientele.

As of today the portfolio is entirely allocated towards small and mid-sized international companies with the smallest (Agora) trading at a $230 million market capitalization and the largest (Wise) trading at a $9.6 billion market capitalization. However, it would be incorrect to assume that we will not own US-based businesses or large-cap companies in the future. In fact, on our focus list today lies Visa, Adyen, and Mercado Libre, three large companies that I would be delighted to own at a more attractive price.

As it sits today, however, I am finding the most attractive opportunities to be within the international small and mid-cap markets. As we have witnessed in the last few months, there are currency conversion considerations at play in the international markets that do not affect domestic-only investors. But I believe that there are two factors that compensate us for assuming this risk.

Firstly, there is an international discount to be had. Earnings multiples are generally lower outside of the United States. These lower valuations are persistent over time but if you view investing as an act of being a partial owner in a business with your shareholdings granting you a proportional right to those earnings, then it is a general matter of fact that higher earnings yields are to be gained by investing internationally.

Secondly, global secular tailwinds are much farther behind internationally than they are in the United States, where, in most cases, they originated. Consider that European auto parts distribution is only 1% consolidated versus the United States which is approximately 40% consolidated. Or that furniture e-commerce is only 14% penetrated in Australia versus 40% penetration in the United States. Finally, consider that more than 80% of salaried job transitions in the United States originate via online job boards versus fewer than 5% in Japanese healthcare. These, and many other global secular tailwinds, are unfolding across the globe similarly to that of the United States, but in a delayed manner.

In addition to this, there is much less capital available globally for businesses to chase down these opportunities. Venture capital is itself a phenomena that originated in the United States and which is slowly spreading internationally. Given this, it is harder for startups to raise seed capital, and companies that do so are incentivized to tap public lines of capital sooner in their life cycles to achieve their growth ambitions. This creates a more favorable competitive environment for our international businesses relative to that of their comparable domestic businesses, which results in significantly lower customer acquisition costs, shorter payback periods, and higher returns on incremental capital.

Consider that there is no real competitor to Raksul or Medley’s core businesses in Japan. Nor is there an e-commerce company selling furniture in Australia except for Temple & Webster. Or consider that InPost operates with a stranglehold on Polish parcel delivery that originates via e-commerce channels. Or lastly, that Basic-Fit operates as the dominant low-cost gym operator in its home region of Benelux, and increasingly across the rest of Europe as well.

There is competition (to be sure) for most of our businesses. But the point remains that there is less capital chasing these large opportunities than there is in the United States. That, in addition to the international discount, makes for a fertile opportunity set to identify investable companies.

Our portfolio companies are riding these global secular waves with leadership positions today. Six of our nine holdings are the de facto low-cost providers within their industries, and all of our nine holdings provide a quantifiably superior value proposition that offers a degree of assortment, convenience and/or simplicity that appears to be defensible over a multi-year time frame.

New Position - Auto Partner

A few months ago I wrote to you detailing our logic for investing in Auto Partner (link). We initiated a position in Auto Partner in March at a cost basis of around PLN 24 per share. There is no need to rehash the entire thesis except to hit the high points. I view this as being a decade-long investment opportunity in a business that is capable of growing revenues in the high-teens for the better half of that period, and in the low-teens thereafter, with increasing annual profit margins. I do realize that that is an extraordinary growth rate to achieve but there are two significant reasons for conviction here.

Firstly, Auto Partner is executing a very similar blueprint to that of AutoZone, O’Reilly Automotive and LKQ, three aftermarket auto parts distributors that have produced similar results in the United States over the last 30+ years. Secondly, the European aftermarket auto parts industry is estimated to be around $150 billion in size with more than 90% of the industry being owned by local mom & pop parts distributors and retailers. Auto Partner currently generates ~$1 billion of revenue and is steadily taking market share from these competitors via its more attractive value proposition that combines superior selection, delivery speeds, and service quality. This definitively superior value proposition is resulting in the steady addition of new customers and the increased spend of those customers through Auto Partner each year.

Auto Partner operates with high barriers to entry as the most trusted brand in its industry, thus allowing them to grow cost-effectively into its home market of Poland and across continental Europe. Less than 1% of the European auto parts industry is owned by the large-scale auto parts distributors, while more than 40% of the market is consolidated in the United States. Auto Partner, therefore, has a large opportunity ahead of itself for the further growth of its business in a controlled manner.

At a 7% earnings yield today; the existing business would be fairly valued if it were merely keeping up with inflation. Yet, it is doing more than that, having grown EPS by 10x over the last eight years with the aforementioned reinvestment runway ahead of itself for further growth in the high-teens for the next several years, if not for the entire decade ahead.

Auto Partner is a Founder-led business with Aleksander Górecki owning more than 44% of the shares outstanding. He and his long-time Vice Presidents have placed customer service at the heart of Auto Partner’s operations. For this reason, Auto Partner has not grown as fast as it probably could have in previous years, because it has refused to compromise on this core objective.

I am therefore happy to allocate our capital alongside these individuals with the expectation that Auto Partner will continue to achieve capital efficient growth at a high rate of return on incremental capital.

New Position - Wise

Wise is a new position that we initiated in early June at a cost basis of £7.89 per share. We have since added to the position at £6.95 when shares briefly traded down intra-day based on speculation of a nonexistent short report.

Wise facilitates cross-border money transfers for personal and business customers across more than 160 countries and more than 40 different currencies. Wise is without a doubt the cheapest, quickest and most frictionless way to move money around the world.

Pre-Wise, moving money has actually been a mostly seamless process as long as it has been done domestically. Tools like Venmo, Cash App and PayPal have been serving this function in the United States for a while now with little differentiation between each other. But as soon as you need to move money to another country in another currency, it becomes expensive and slow. More than £11 trillion is moved cross-border each year (£2 trillion by individuals and £9 trillion by businesses) with approximately £219 billion (or 2%) being paid out in fees. This cost is inordinately paid out by the consumers and small businesses, who are charged 4-7% per transaction relative to institutions, who receive scale-based discounts. Not only that, but the money frequently takes 2-5 business days to reach its end-destination and each transaction typically requires an in-person visit to a local bank branch.

These fees may not seem like much, but when you compare it to Wise’s average cross-border take rate of 64 basis points, Wise is 7-8x cheaper than the average bank transaction.

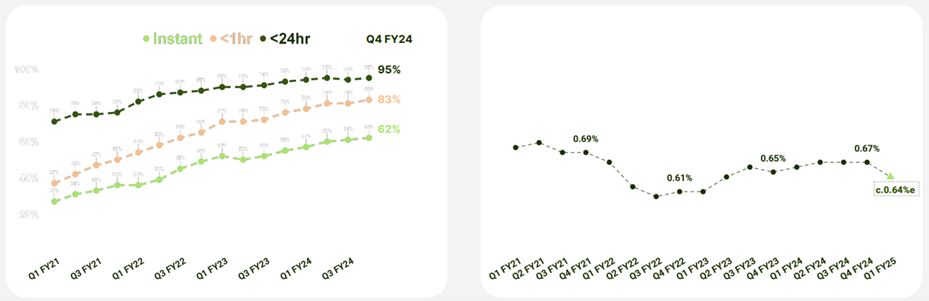

This is compelling, especially for individuals and small businesses who travel internationally, or who move money cross-border on a regular basis. When you add in the fact that 62% of these transactions are completed instantly via the Wise mobile app or website, and do not require physical trips to bank branches, then you can begin to see how this four-pronged value proposition (lower costs, faster delivery, convenience, and transparency) is highly attractive versus using a bank.

The question might arise then; why is it so expensive to use banks and why is the experience so bad?

Firstly, there is little to no transparency required of banks. Banks therefore hide their fees and exchange rate markups with opaque pricing because they have historically had a captive customer base. Without transparency or competition, there has simply been no incentive for banks to lower their fees or improve their service.

Image taken from the IPO prospectus in 2017; note that Wise’s average fees have declined with scale to 0.64% while also the percentage of instant payments has also increased.

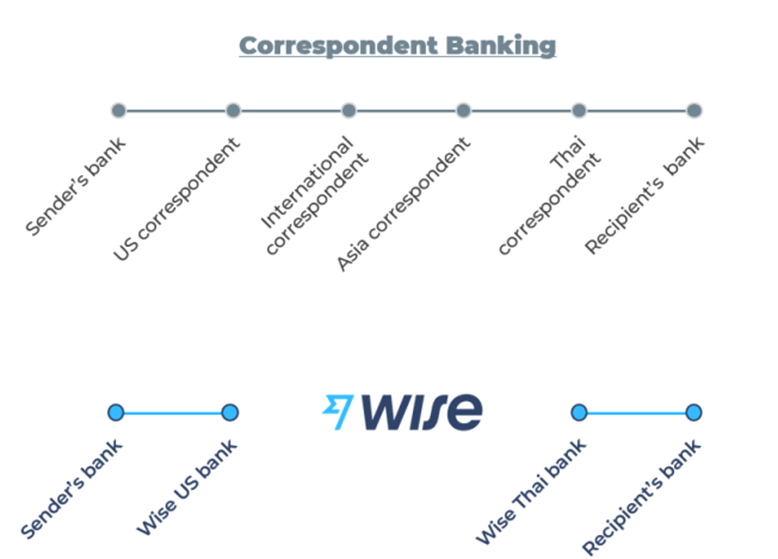

Secondly, banks still rely on a correspondent banking model (called SWIFT) which was created in the 1970s and which has gone unchanged with little innovation for more than two decades. This banking model is slow and inefficient, involving multiple middle-agents, each with their own individual markups. But Wise has built its own infrastructure to replace correspondent banking by bypassing it entirely. As noted, most countries already have fast, cheap, efficient payment networks. Wise has simply stitched these networks together into one global network.

Also from Wise’s 2017 prospectus. Wise eliminates four agents from this example transaction.

This infrastructure has made transfers easy, increasingly fast, and increasingly low cost. Every year a greater percentage of transactions complete instantly and the average transaction fee continues to decline.

This is a key point. Wise could have kept the increasing economies of scale for themselves but they have instead consciously decided to further reduce their own take-rates as a continuation of their strategy to be the global low-cost provider. Wise therefore becomes increasingly cheaper for customers with each passing year, thus making the value proposition increasingly more attractive relative to that of banks, which have maintained their fee structures. Further, these banks are physically unable to respond to Wise given that they still operate on antiquated infrastructure. Banks are incapable of recreating Wise’s solution because of the regulatory limitations imposed on them that prevent the comingling of client’s assets (which is discussed in more detail below).

Wise can do this because most “transactions” do not actually cross borders. If, say, I wanted to travel to Paris to attend the Olympics and I needed to transfer $5,000 into euros for my trip, in most cases, with a Wise transaction, my $5,000 does not actually leave the United States. Instead, it gets deposited into Wise’s US-based bank account and deducted from Wise’s European bank account. In neither case does the money leave Wise’s ecosystem until this money is either deposited into the end-user’s bank account or used by the end-consumer via Wise’s Accounts product.

It sounds simple, right? In theory, yes. But it gets significantly more complicated when you consider that each day hundreds of millions of pounds are “moved” via transactions across more than 160 countries in more than 40 local currencies. Wise has built out an infrastructure that is capable of handling that type of volume to ensure that each Wise-owned bank account in each country has the available funds to meet liquidity needs for customers on a daily basis. In the event that more money is needed in a particular region, only then is cash moved cross-border.

This treasury mechanism that I just described is essential to understanding why Wise is so capable of being the low-cost provider. With every incremental transaction Wise’s system gets more efficient and gives Wise serious control over its cost of sales despite significant increases in year-over-year transaction volume. Wise has chosen to pass these savings on to its customers via lower transaction fees in order to realize its mission: to build the best way to manage the world’s money. Minimum fees. Maximum ease. Full speed. This mission, which is hammered into the DNA of the company, guides Wise to build things that customers need based upon its pillars to provide instant money transfer, at a convenient, best-in-class service, with maximal transparency, at lower costs. A pertinent footnote to this is that Wise makes it a point to do so profitably.

In addition to this, a true international banking experience does not exist yet. Just like sending money, managing money across borders is similarly broken, forced to rely on systems that are built for domestic use. Wise is fixing that via its adjacent business lines (Accounts, Business, and Platform), all of which are built on top of its core infrastructure, but which are not themselves a bank, thereby allowing Wise to avoid the regulatory burden of banking.

These products allow individuals and businesses to access their money across multiple countries and currencies, with local bank account numbers available through Wise in partnership with local banks, but accessed and utilized through the Wise app. This allows customers to pay suppliers in local currencies and also to use a physical Wise debit card that runs on Visa’s rails that allows customers to spend money anywhere in any currency.

This is all enabled via the stitched-together infrastructure that Wise has built. There are competitors, but Wise has a significant lead in both the number of channels that it facilitates as well as in the cost savings that it passes through to customers, making it the (likely sustainably) low-cost provider in most channels that it operates through.

This might seem like an easy thing to replicate but I have heard (via direct conversations with former Wise and Remitly employees, and via AlphaSense and Tegus transcripts) that it is an extremely difficult process in reality, requiring multiple steps of regulatory approval that is unique to each individual country and which does not actually become easier for each incremental provider that is following in Wise’s wake.

But the more important point to consider in regarding competition is that Wise primarily competes with the banks, which are not only disincentivized from competing with Wise, but which are also structurally unable to do so. Some of the larger banks (JP Morgan, Bank of America, HSBC) have regional presences in the most active channels (i.e. US <-> UK; US <-> India; UK <-> EU; US <-> Mexico, etc.) but the correspondent system is still in place with the usual opaque fees and physical presence being required. This analysis includes Western Union, the world’s largest remittance company, which is similarly dependent on SWIFT, requires physical presence on both ends of the transaction, and which charges a markup in addition to the current exchange rates.

In 2022, more than £2 trillion was moved cross-border by individuals. Based on Wise’s 2024 individual transaction volume of £87 billion, this amounts to 4.3% of the market. The vast majority of this is still owned by banks (>90%). Further, more than £9 trillion was moved cross-border by businesses and based on Wise’s business volumes of £31 billion in 2024, this amounts to 0.3% market share. Approximately all of this business volume is still transferred by banks. It is therefore not an exaggeration to say that Wise’s market share is near-trivial at this point.

Despite this low market share, Wise has created a sizable business. In the last twelve months Wise facilitated £119 billion in cross-border transactions (+13% y/y), generating £795 million in cross-border revenue (+17% y/y) across nearly 13 million active customers (+28% y/y). Importantly, of Wise’s 5.4 million new customers gained in 2024, two-thirds of these joined via word-of-mouth recommendation from existing Wise customers. I think it goes without saying that this is an incredible data point as it speaks to the compelling value proposition that Wise has created, such that it has created a highly evangelical customer base. Wise’s decision to keep lowering its transaction fees not only serves to enhance Wise’s position as the low-cost provider, but it creates an incrementally more compelling value proposition that helps to fuel further growth.

But cross-border transactions are only a part of Wise’s revenue streams (58%) with the rest coming from the adoption of the previously mentioned adjacent products that Wise offers. Today 48% of existing Wise personal customers and 60% of business customers also use Wise’s Account product.

This Account product functions as a bank account for customers without being an actual bank account itself. Assets held in these accounts have risen by 360% in the last three years, swelling to over £13 billion at the end of FY24. The rising adoption of the Account product has led to the creation of two additional revenue streams. Card revenue and Interest income. Card revenue amounted to £257 million in 2024 (+54% y/y) while Interest income amounted to £121 million (+143% y/y). This increase in interest income is due to a 24% increase in customer Account balances, and also a significantly higher interest income yield environment.

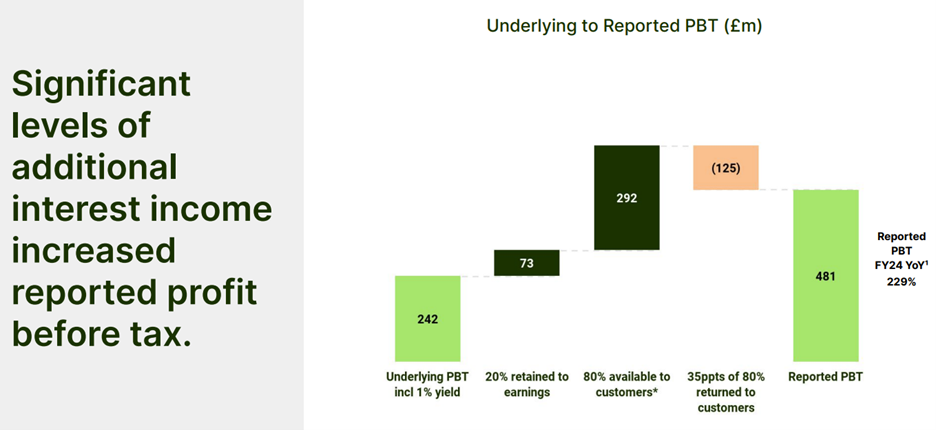

Both revenue streams are high-gross margin businesses, but interest income, in particular, is especially high. It has had the effect of artificially inflating gross margins and EBITDA margins beyond what the company would be producing in a more normalized interest rate environment.

Wise intends to keep the first 1% of this interest income and to pass 80% of the remaining interest above 1% through to the consumer. I say “intend to” here because Wise hasn’t actually been able to accomplish this. In 2024 Wise generated £242 million of profit before tax (PBT) if interest rates had been at 1%. Given the favorable interest rate environment, an additional £365 million was generated in interest income, of which Wise kept 20% (or £73 million) leaving 80% (or £292 million) that it intended to return to clients. Only £129 million of that £292 million was actually returned to clients because the majority of these assets held in Accounts are UK-based and Wise is unable to pay out interest to UK-based account holders under the terms of its license. It could therefore be said that Wise over-earned in 2024 by £239 million by producing £481 million in reported PBT or 100% higher than what the true underlying PBT would have been in a 1% interest rate environment. If all of that was confusing, please see the below waterfall chart.

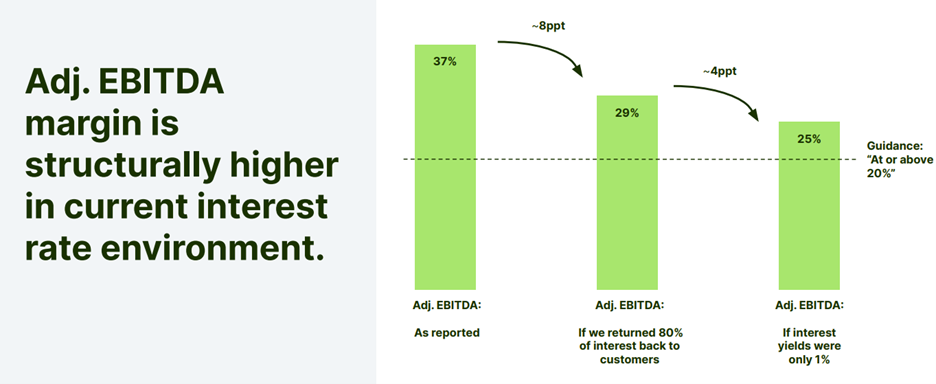

If Wise had been able to return all of the 80% of interest above 1%, EBITDA margins would have been significantly lower, at only 29%. And if the interest rate environment had been only 1%, EBITDA margins would have been 25%.

The net effect was £481 million of reported PBT (a 34% margin; based on revenue of £1.4 billion); of which more than 100% dropped to free cash flow for a current LTM earnings yield of 7.5% (or 13x cash earnings).

However, if 2024 had been a 1% interest rate environment, Wise would therefore have produced £242 million in PBT, thus insinuating that it could, in fact, be trading at a 3.7% earnings yield (or 27x earnings).

So what to make of this? On the one hand a case could be made that Wise is incredibly cheap. 13x earnings for a business that has grown earnings 10x in only 24 months? Sign me up! On the other hand, Wise has only grown “normalized” earnings by 6x in the last two years and trades at 27x earnings today. A high price to pay for a business that is currently overearning.

As with most things, I think the true valuation lies somewhere in between. Forewarning: If you don’t feel up to reading math, feel free to skip the next three paragraphs.

Wise invests its customer balances primarily in short-term AAA, AA, Aa, and A securities, where yields have almost never been 1%. To call a 1% interest rate environment “normal” strikes me as overly conservative. Which brings up an important point. Wise’s management team has been historically highly conservative. Not only has Wise outperformed its earnings guidance in every quarter/year since becoming publicly traded, but they also upgrade their guidance multiple times throughout the year and then go out and beat those upgrades as well. Wise’s management team has a history of being highly conservative and I think that a 1% normalized interest rate environment is another such example.

Another thing that people miss in chalking Wise up to being expensive is that the assets in the Accounts business are continuing to expand. Through the first quarter of FY25, assets have grown by a further £1 billion to £14.1 billion (+23% y/y; +7.6% q/q) and we remain in a high interest rate environment. If Wise continues to add an incremental £1 billion in each of the next three quarters, assets will increase to ~£17 billion at the end of FY25. A 5% interest yield on £17 billion amounts to a potential interest income of £850 million. Excluding the first 1%, which Wise keeps, this amounts to £680 million of incremental interest, of which 20% (or £136 million) will be kept by Wise with the hopes of returning 100% of the remainder (£544 million) to customers. As previously mentioned, much of these assets are held in UK-based accounts and Wise is unable to return that interest. If Wise is able to return half of that amount to customers, it will result in another year of “over-earning” with an incremental £272 million of incidental earnings.

Interest income kept by Wise in FY25 could therefore be £150-170 million (the first 1%) + £115-136 million (20% of incremental interest above 1%) + £250-272 million (incidental earnings on interest unable to return to customers) = £515-578 million of interest income alone which then gets added to the underlying PBT of £208-256 million (based on revenue estimates of £1.6 billion at a 13-16% margin, per management guidance that they are likely to outperform) meaning that total free cash flow for Wise in 2025 could amount to £708-834 million, indicating a NTM earnings yield of 11-13% (or 8-9x earnings).

So what does true “normalized” earnings look like? I’m not entirely sure. But I do believe that it is likely higher than Wise management’s estimates of it being a 1% environment. It also seems quite clear to me that Wise is going to be legally unable to return interest to its UK-based customers, of which there are many, thereby resulting in multiple future years of “incidental” extra earnings.

However, all of this analysis of interest rate fluctuations and what true “normalized” earnings might be is of minimal relevance if you first buy into the core part of the thesis that Wise operates with structural cost advantages in a market that it is still deeply underpenetrated in. Similarly to Auto Partner, Wise could quadruple its cross-border payment volume and still have only 4% market penetration, with the banks retaining >90% market share. This is truly an enormous market that Wise is in the very early years of consolidating with a defensible competitive advantage (again, similarly to Auto Partner) that banks are structurally incapable of replicating.

At some point in the future, banks will have to respond to Wise or risk losing a profitable stream of revenues. FX conversion is only a small part of what banks do, but it is suspected to be a high-margin line of business. Eventually banks will either yield the entire market to Wise and its competitors, or they will respond.

To that end, Wise has been working to build out a white-label solution that functions on the back-end of a banks’ internal processes to provide FX conversion. Many neo banks (or digital-forward banks) have already signed up for this service and provide Wise’s white-labeled service as if it were its own service. In the future, be it next year or ten years from now, the larger banks will feel increasing pressure to respond to Wise (and Remitly and others doing similar Wise-like FX functions) because not only will they be losing out on the FX transactions, but as we have seen, customers tend to keep their money in the Wise Accounts, thus affecting customer deposits at banks, which gets to the heart of a banks’ business. If and when these banks respond, Wise wants to be the best positioned company to be the white-labeled provider of choice. This will result in a step-function change in volumes such that Wise’s current FX volumes may only be miniscule compared to the overall volumes that would be achieved in this scenario.

Going forward the thesis is effectively this: I believe that it is highly likely that Wise can grow its “normalized” earnings at a 15% per year clip for at least the next five years, with a reasonably high probability of it being in excess of this. I also believe that regardless of the interest rate environment, there will be significant incremental earnings from the 1% of interest earned on Account balances as well as the 20% of interest in excess of 1% in addition to these incidental earnings that Wise is unable to pay out to customers. This merely increases the odds that Wise exceeds 15% per year earnings growth or higher. At 27x LTM normalized earnings, perhaps that multiple contracts over time to 20x over the next five years, resulting in a CAGR of -6%. Dilution is about 1% per year, so you end up with a rate of return that looks like this: 1.15 * 0.94 * 0.99 = 1.07, or a 7% total annual shareholder return over five years. I think that this is perhaps a base case/borderline bear case for Wise, with there being significant room for outperformance at a rate that far exceeds these estimates.

For example, per my previous analysis, Wise’s true normalized earnings could actually be much higher than their current estimated normalized earnings. Multiples could therefore not be 27x LTM earnings, but actually in the 14-16x range. Not only that, but assets in the Account business could continue to grow at a £1 billion per quarter clip or more, thus resulting in interest income that is significantly larger than last year’s amount. Furthermore, the cards business, which currently makes up 22% of revenue, growing 54% y/y, could continue its upward trajectory. Earnings could therefore grow at 20-25% over the next five years, with multiples expanding (rather than contracting) from ~15x to 20x at a 6% five-year CAGR. In that scenario, you would have the following: 1.25 * 1.06 * 0.99 = 1.31, or a 31% five-year CAGR amounting to a 380% increase in shareholder value, while still having only gained a few percentage points in terms of total market share. Wise would therefore continue to maintain an extraordinarily long runway for continued growth at high rates.

Now would probably be a good time to mention that Wise is debt-free and produced 45% returns on capital last year (~25% if you deduct incidental interest income).

Lastly, it is worth mentioning that Wise, like nearly every other company in the Asheville Capital portfolio, is Founder-led with Kristo Käärmann still working at Wise as CEO. He remains an 18% shareholder in the company. I highly recommend you listen to him speak (link) as he is exceptionally skilled at it and, just like Wise’s value proposition, he is highly transparent.

Conclusion

In sum, it has been a tough start to the year. I am somewhat encouraged by the increase in portfolio value through July but more than anything by the continued execution of our businesses. We have seen drawdowns across several of our portfolio companies, especially in Japan, despite continued financial performance that is in-line with our theses. I remain patient with these businesses, feeling confident (via intense research and analysis) that we have paid a fair price for our businesses. In the event that there are further drawdowns in excess of 20%, we will likely continue to happily add to these positions. I do not blindly “buy the dip”, but as long as our theses remain intact and the prevailing market prices imply growth that I deem to be less than reasonable, then we will continue to add to the extent that we can.

Last but definitely not least, I am extremely grateful to you, our investors, for your continued support and patience. The interim period between investment and outcome truly is the most difficult part of this job. I feel the stomach-lurching effects of watching our companies crash in value by 20% or more within short periods of time, but I also believe we will look back on this period as an extraordinary opportunity to have been invested in the markets, especially with the world-class businesses that are in our portfolio today.

This difficult interim period is made immensely easier to bear knowing that I have gained your trust. You have allocated a portion of your family’s wealth to me with the expectation that I will grow it, and that is a responsibility that I take very seriously. As you know, I consider it my chief aim in this professional life to faithfully manage the assets that you have entrusted to me.

Thank you for your time and attention. Please do not hesitate to reach out to me if you have any questions or concerns.

Sincerely,

Jake Barfield

Hi Jakes, Thanks for this very informative. Curious though why you prefer Wise over Remitly as an investment. I see them both with similar annual revenues but Wise is trading at almost a 3X Valuation. Granted I know Wise carries no debt but seems Remitly is just as good (if not better) of an investment?

Hi Jake, Listening to your podcast on Shift Inc and was wondering if you have any thoughts on it currently. I came across it earlier this year through a screen and passed on it due to valuation but it starting to look pretty interesting at current prices. Are you aware of any good research on this company?

Thanks for all the great content that you share!