Medley Inc. (4480.JP) Investment Thesis

Medley is a world-class business that is not broadly appreciated as such.

The following is an investment thesis written to Limited Partners of Asheville Capital Management, that is reproduced here for your benefit. It is not intended to be investment advice. Readers who wish to learn more may visit ashevillecapitalmanagement.com or reach out to Jake Barfield, Asheville Capital’s founder and portfolio manager.

Introduction

For many of you, this will be the first time that you have ever encountered Medley, Inc. (4480.JP). The “little-known” nature of Medley, and indeed most of the names within the Asheville Capital Portfolio, is merely a byproduct of the consistent application of our investment strategy – to invest in world-class businesses before they are broadly appreciated as such.

Medley is similar to every company within the Asheville Capital Portfolio in that it is uniquely skilled at producing substantial value for the industry that it operates in. This unique value proposition enables Medley to grow its revenue and subsequent profits at rates of return on incremental invested capital that is far in excess of that of their publicly traded peers. Further, Medley’s value proposition is not easily replicable. Said another way, Medley competes with durable competitive advantages. Competitors are either incapable of, or heavily incentivized not to respond to Medley’s value proposition. This is allowing Medley to win incrementally larger chunks of market share with each passing year, and to do so capital efficiently, thereby producing returns on incremental capital that are both extraordinarily high and predictable. As a result, returns on total capital continue to grow.

It is the opinion of your portfolio manager that returns on total capital are likely to continue to expand towards, and that they will remain in, the top-decile of the public equity universe. Further, the current share price implies an expectation that Medley only achieves a fraction of what I believe to be reasonable. These predictions, if directionally accurate, yield an asymmetric expected return on today’s share price.

Overview

Without further delay, let’s begin our analysis. Medley is a Japanese healthcare technology company that operates two business segments: HR PF (Human Resources Platform) and Medical PF (Medical Platform). HR PF generates revenues through its job matching website, JobMedley. Medical PF is a collection of mission-critical software systems for hospitals, clinics, pharmacies, and dentist’s offices. Both HR PF and Medical PF are the cheapest options for their customers by wide margins. Yet, Medley, despite being the low-cost provider, is also the most profitable business in each of their industries. This is because Medley has leveraged technology to remove structural cost burdens from both businesses models, which allows them to offer cheaper prices for better services while capturing higher profit margins.

On a consolidated basis, Medley produced ¥18 billion ($127 million) of revenue in the last twelve months, ¥12 billion in gross profit (68% gross margin) and ¥3 billion in net income (17% net margin). Free cash flow is higher than net income, at a 19% margin, due in large part to a negative cash conversion cycle that is an attractive feature of the HR PF business. In the last four years, consolidated revenues and profits have grown at a compounded annual growth rate of 49% and 120%, respectively. Through the first half of 2023, Medley is not slowing down, with revenues and earnings increasing by a further 52% and 75% year-over-year. In addition to being profitable, with expanding profit margins, Medley is well-capitalized with more than ¥14 billion of net cash on its balance sheet. Medley’s shares currently trade at 6.5x 2023 sales, 9.5x gross profits and 32x free cash flows.

As you are about to learn, Medley has two durable revenue streams and is heavily insulated from competition and from the cyclicality of capital market cycles. In addition to this, there remains a decade-long reinvestment runway at increasingly attractive returns on incremental capital.

HR PF Business Segment

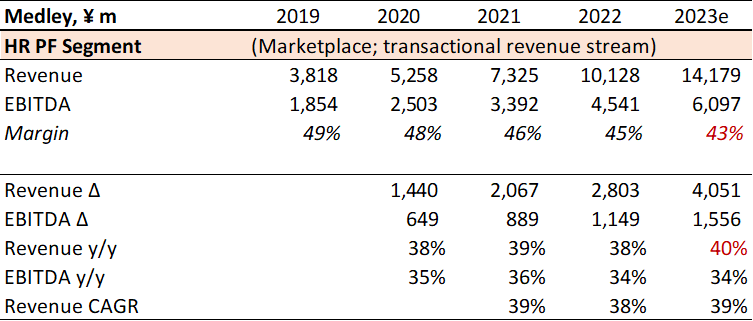

HR PF is the metaphorical cash cow of Medley’s two business segments. It operates with 45% EBITDA margins and has grown (entirely organically) at a 39% compounded annual growth rate for the last 4.5 years. HR PF’s primary revenue-generative asset is a website known as JobMedley.

JobMedley is Japan’s largest recruitment website in the healthcare industry. It is a two-sided marketplace with healthcare clinics on one side and healthcare workers on the other side. Healthcare clinics simply post job openings to JobMedley and then applicants apply. JobMedley itself is hands-off in the application process, and merely serves as the “plumbing” by which communication flows.

JobMedley earns revenue by charging the clinic a success fee once that clinic has hired an individual from the applicant pool. The success fee ranges between 2-13% of an individual’s annual salary, with the average ‘take rate’ being 5%. For example, if a new hire signs a contract for a ¥6 million annual salary ($40,000), then JobMedley charges the clinic, on average, ¥300,000 ($2,000), payable within 30 days of the new hire’s start date.

Now… that might seem like a lot of money being paid out by the healthcare clinic for a fairly simplistic task. On an absolute basis, you are correct. It is a lot of money. But on a relative basis – the basis by which ‘value’ is determined – JobMedley is by far the most cost-effective and convenient solution in the industry.

The Japanese healthcare industry is simultaneously experiencing an aging population and a shrinking workforce. To make matters worse, medical costs are rising and the complexity of care is increasing. Talent has never been more valuable to healthcare providers in Japan. Yet, at this exact same time, talent has never been scarcer. Demand far outstrips supply.

Furthermore, technology is heavily underutilized in this industry. As a consequence, there is a significant premium that healthcare clinics are willing to pay to acquire talent. In Japan, these trends (aging population; scarce talent) are anticipated to run over the course of the next several decades, and therefore this premium is likely to hold over the long-term. Technology is beginning to be utilized more frequently by these clinics and there is only one scaled provider in the market… JobMedley.

The marketplace dynamics of JobMedley’s business model make it highly likely that this industry evolves into a winner-take-all dynamic. The reason being that the scaled provider offers the applicant pool the largest number of job openings and ipso facto, the healthcare clinic customers are incentivized to turn to the largest source of supply in order to attract the highest number of qualified applicants.

Additionally, there are substantial barriers to scale that make it cost ineffective for new entrants to compete. Recruit Holdings (6098.JP; the parent company of Indeed) has tried to enter the medical industry previously and exited shortly afterwards. SMS Co. (2175.JP), Japan’s largest medical headhunting service tried to enter with a digital marketplace of its own in 2011. That service is still active, but it generates minimal revenues today and is no longer a priority for SMS’ management team. Guppy (5127.JP) meanwhile is carving out a niche for themselves with dentists, but its pricing model makes it more expensive than JobMedley, and so Medley continues to enjoy high win rates with dentists’ offices as well.

The problem that each of these new entrants face is one of fragmentation. The demand-side of JobMedley’s marketplace (the healthcare clinics) is extremely fragmented, with over 1.1 million offices comprising more than 10 million employees. Out of those 10 million individuals, approximately 78% of them work in small offices in specialties and rural regions where job placement is least-competitive. Said another way, there is a long-tail structure to this industry that makes it not only difficult, but cost-ineffective for new entrants to try to build a business into.

Medley has achieved scale with these 1.1 million providers through years of investment into building up its marketplace with technology that makes their business model asset-light and profitable despite a miniscule take rate relative to what the industry has become accustomed to. For a second player to enter the market and to achieve scale, it would require further investment and years of unprofitability to garner any significant degree of market share. Companies who have already established revenue streams within their own particular specialties have found it therefore unattractive to enter. New entrants, meanwhile, face the same hurdles that Medley has previously cleared, albeit this time with a competent player in place (JobMedley) who has already achieved scale.

Recruit Holdings runs a similar marketplace to that of JobMedley and has historically specialized in the technology industry. Recruit charges a success fee but has found it very difficult to move “downstream” to the healthcare industry because the 5% average success fee for a dental assistant, for example, is well below that of the average software engineer. JobMedley earns, on average, ¥150,000 per placement which is only 20% the average fee that Recruit earns per placement, despite the similar 5% take rate. Additionally, as previously mentioned, success in healthcare requires building relationships with hundreds of thousands of customers who are not technologically savvy, and who require an enormous amount of trust to even consider using a different service provider.

Similarly, SMS Co., despite being in the healthcare industry already with its agency model, is strongly disincentivized from moving towards an online-only model. SMS Co. has a 25 year history of operating as a headhunter and charges, on average, a 30% success fee for placing a candidate into a job. SMS’ approach is heavily intermediated. An agent pre-interviews all of the available applicants and attends each of their interviews in-person. If SMS were to disrupt itself and attempt to compete online, it would cannibalize 83% of its existing revenue stream. This would require mass layoffs of its agent employees, each of whom have built entire careers networking and building relationships with their clientele. There would be permanent damage to SMS’ brand among its base of recurring clients and, perhaps most importantly, it would require slashing a decade-long dividend in order to invest in a business that would require a minimum of 5-7 years to achieve profitability, if ever.

Because of this, SMS has chosen to operate in the “head-tier” of this market, focusing almost exclusively on nurses and doctors who generate the highest success fees. SMS receives, on average, ¥750,000 per job placement, and has little interest in encroaching on Medley’s turf where the average placement fee is ¥150,000. 1 For all of these reasons, SMS has communicated that it has no interest in moving downstream to compete with Medley. The mid- and long-tail of this market, therefore, (78% of all jobs) is one that Medley enjoys almost entirely to itself.

In sum, there are tremendous barriers to scale that insulate JobMedley from competition.

Despite JobMedley having a dominant position in the long-tail market there is still an extremely long runway for growth. Approximately 1.5 million healthcare workers change jobs each year (15% of the total workforce; average tenure of 6.7 years). Medley, in 2022, garnered approximately 75,000 of those job transitions, or 5%. The vast majority of these job transitions occur via local magazine advertisements and via a free government service called Hello Work.

Hello Work is the Japanese government’s employment service center. It also functions as a benefits manager for unemployed workers. Hello Work was established in 1953, and in the pre-internet era, it was the only major service in Japan for filling job postings. It is a free service, and therefore, is often the first step that most employers (healthcare clinics included) take towards filling a job posting. Despite this, it is inconvenient because employers must visit one of the 544 government offices during business hours and submit paperwork describing their job posting. There is an online webpage, but there is no verification of information or matching services.

As a result, Hello Work is rife with misleading information. A report published five years ago by the Business and Human Rights Resource Center found that 41% of job postings contained fraudulent information and that a large percentage of job postings come from burakku kigyo (translated as “black companies”) who operate outside of compliance to Japan’s Labor Standards Act, with poor working conditions, misleading pay rates and longer than advertised working hours. 2 Hello Work is free and therefore highly utilized by health clinics but it is consistently losing market share to Medley. Further, there exists zero incentive for the Japanese government to try to compete with Medley. The only reason Hello Work exists in the first place is because job-matching services like those provided by JobMedley were not available pre-internet.

Lastly, with each passing year there are new college graduates entering the workforce, with each cohort being marginally more digital native than the last. Medley is extremely well positioned with these groups of individuals and this is allowing them to engage with the increasingly scarce talent of this industry in a way that provides substantial value for Medley’s customer base (the employers) who desire to connect with this scarce talent in a time-efficient manner to fill their job postings. After a number of years, these college graduates frequently start their own practices, and frequently return to JobMedley to fill their bench of employees.

JobMedley therefore has a white space market opportunity ahead of them that is 10x their existing scale merely by capturing incremental market share from their inferior substitute (Hello Work; which comprises ~50% of all healthcare-related job placements) which, again, has no incentive to compete with them. JobMedley is not merely competitively advantaged, but in fact, occupies a monopolistic position despite being underpenetrated in its market. This therefore makes it highly likely that JobMedley grows to multiples of its existing size.

JobMedley is currently a ~¥14 billion ($93 million) business producing 45% EBITDA margins and has grown, organically, by 370% in the last four years (39% CAGR). Medley’s management team believes it is reasonable for HR PF to grow by a further 30% CAGR for at least the next five years while also maintaining its already high profit margins. Despite this seeming like a lofty goal, this guidance implies that Medley captures a mere 18% of its addressable market. For what it is worth, Medley has a history of guiding very conservatively and outperforming its guidance by wide margins.

Medical PF

If HR PF is Medley’s slow-growing (39% revenue CAGR) cash cow (45% EBITDA margins), then Medical PF is Medley’s fast-grower that is expected to break-even this year. In the last four years, Medical PF has grown its revenue, both organically and inorganically, by 14x (94% CAGR), and is up a further 86% year-over-year (organically) through the first six months of 2023.

An extremely important, but little known, fact is that Medley has paid, on average, between 1-1.5x sales for each of the six businesses that it has acquired in the last few years. Not only are these businesses immediately accretive to shareholder value, given that Medley currently trades at ~7x LTM sales, but Medley is also able to juice those companies’ growth rates through its cross-selling capabilities. Most of the time, these businesses are growing revenues in the 10% range pre-acquisition. Medley has been able to grow each of them by 50% or more for multiple years post-acquisition. Not only that, but the founders of these acquired companies tend to stick around. Most of them have stayed with Medley and have continued to advance their own products through the increased marketing and research muscle that is now available to them through Medley. Acquired founders are given the opportunity to focus on the avenue that they most prefer (e.g. sales or research). Five of six acquisitions have been a 100% buyout.

Medical PF is focused on developing software as a service (SaaS) products that function as mission-critical services for healthcare clinics. Among the product offering is CLINICS telemedicine, CLINICS electronic medical record (EMR) system, Pharms (cloud-based pharmacy support system), MEDLEY (online medical encyclopedia), MALL (EMR for hospitals), and Dentis (cloud-based dental clinic support system).

Medley is growing the Medical PF business segment capital efficiently through the scale that they have already achieved in the HR PF business. JobMedley has accumulated a customer base of more than 300,000 clinics in Japan (~28% of the industry). Medical PF is leveraging JobMedley’s brand to sell software services to these clinics.

There is a tremendous unmet need for modern operating systems in Japanese healthcare. A third-party market research firm estimated that the Medical IT System market in 2020 was ¥468 billion ($3.1 billion), with approximately 58% of that total expense going towards on-premise EMR systems, and another 40% being “others” which are difficult to quantify and frequently include paper-based systems. Only 2% of the entire industry is utilizing a cloud-based software solution for any aspect of their practice.

Medley’s value proposition is simple – Customers, in switching to Medley save, on average, 50% of their annual expenditures for EMR systems. They get the cost savings, but they also get a significant product upgrade to a modern solution that combines high-level functionality and simplicity.

The healthcare IT industry is not merely underpenetrated and growing linearly. But rather, its growth is accelerating since the onset of the COVID-19 pandemic. The outbreak increased consumer awareness and behavior toward digital utilization, but it has also revealed the need for greater speed and efficiencies in processing patients, scheduling appointments, recording medical records in a timely manner, and in filling prescriptions, among many other shortcomings.

The most important observer of these shortcomings was the Japanese government itself. In 2022, the government announced and implemented deregulations and policies related to the promotion of online medical services and electronic medical records for the revitalization of regional healthcare through digital utilization. The Kishida Cabinet has listed Digital Transformation within the medical industry as a priority investment, and it has followed up on this statement by promoting the standardization and implementation of EMRs among all healthcare facilities.

It goes without saying that Medley is extremely well positioned in this respect. Medley is the current market share leader in cloud-based EMR (with an estimated 30-40% market share) and is best-positioned to continue to grow revenues organically in a capital efficient manner going forward. They also have the balance sheet (¥14 billion of net cash) to continue to grow inorganically and have demonstrated the capital allocation discipline to make deals that do not simply grow revenues, but which are immediately accretive to both customer and shareholder value.

We have seen in other countries around the world that mission-critical software services are extremely sticky products. EMR products, in particular, are among one of the stickiest solutions in all of software. Hospitals rarely migrate off of an EMR system until forced to either by government regulations or extreme antiquation. Healthcare providers in Japan are experiencing both of these forces at the same time, which is necessitating a switch to a modern service provider. Medley’s compelling value proposition (50% average annual savings, simpler workflows) makes it increasingly likely that they will continue to garner large order volumes from their target market which, again, is only 2% penetrated.

Through the first six months of the year, Medical PF’s revenues are up 89% year-over-year due, in large part, to the winning of several large EMR orders from hospitals in the first quarter. Medley is guiding for “40% or higher” revenue growth in Medical PF, however it seems quite clear at this point that they will exceed these expectations by a significant margin. If Medley were to merely grow Medical PF’s 2023 revenues by 60% year-over-year (implying 3% sequential growth in 2H’23), then they would generate approximately ¥6 billion (~$40 million) of revenue in 2023.

Medley’s management team has indicated that they believe it is possible for Medical PF to grow by 30% or more, organically, over the next ~5 years. If this were to happen, they would have only achieved 4% penetration among their target customers. This might be further accelerated by any future acquisitions.

Given this information, it is reasonable to envision a future in which Medical PF’s revenues are 2x, 5x, or even 10x of its existing size. In either of those scenarios, Medical PF will have captured a meager 2.5%, 6.3%, and 12.7% of their addressable market.3 Medical PF is expected to achieve break-even segment-EBITDA this year and anticipates gradually increasing its margins each year going forward. At-scale profit margins have not been guided for by Medley’s management team, but it would not be unreasonable for this segment to reach the 20-30% range, and potentially much higher, given the superior gross profit margins to be earned by these products, coupled with the fact that HR PF business currently generates 45% EBITDA margins despite lower gross margins.

Insider Ownership

One final point to make before getting into valuation. Medley is led by its Founder and CEO Kohei Takiguchi. Despite it being 15-years later, Kohei remains Medley’s largest shareholder with 18% of the shares outstanding. An additional 11% of the shares reside with Goichiro Toyoda, a President and Board Member, and another 9% is held by Medley employees and executives. Medley does pay out stock-based compensation, but this amount has historically been well below 1% of sales and is treated as the expense that it truly is. Medley repurchases shares on the open market to offset the majority of this dilution.

Consolidated Forecast/IRR Estimation

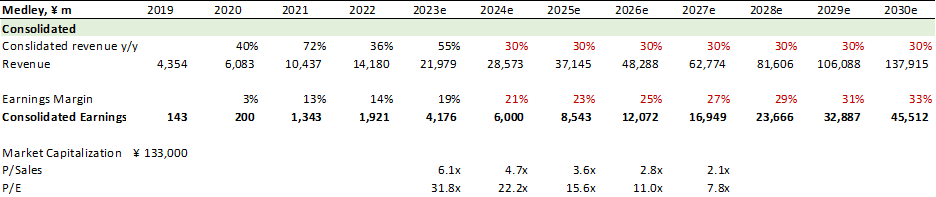

On a consolidated basis, Medley will be releasing its next mid-term plan in February 2024. This guidance is expected to run through 2030. Medley has already disclosed that they anticipate presenting a ~30% 7-year revenue CAGR from 2024-2030 and intend to expand their profit margins each year, with the mid-term policy of “maintaining high sales growth” and the long-term policy of “maximizing long-term free cash flow”.

Given this general guidance, we can estimate the amount of revenue and earnings that Medley believes it can produce through 2030.

Simply put, it will be nothing short of incredible if Medley achieves this guidance. A 30% 7-year revenue CAGR will see Medley grow its revenues by 6.5x from ¥20 billion ($130 million) to more than ¥130 billion ($860 million). Similarly, if profit margins were to expand by 200 basis points per year, earnings will expand from ¥4 billion ($27 million) to ¥45 billion ($305 million), a 41% CAGR. If our investment into Medley were dependent upon the binary yes/no achievement of these growth metrics, then I would not be writing to you today.

Rather, Medley merely needs to continue to grow revenues and profits at a high-rate over the next 2-3 years for our shares to re-rate precipitously. Despite this, it is my intention to own Medley for the next decade, or longer, based on the aforementioned advantages that Medley operates with and the long runway for continued reinvestment at attractive rates of return.

Our cost-basis for Medley is ~¥4,100 per share, a ¥133 billion market capitalization and a ¥121 billion enterprise value. Taking the higher of the two, Medley trades at approximately 6x FY23 sales, 9x gross profits and 32x earnings. Revenues and gross profits have grown by 52% year-over-year, while earnings have grown by 118% and are in the earlier years of an inflection point that could see them continue to increase by 200-300 basis points per year for the next several years.

Absent dividends, which Medley is not paying, a simplistic estimate of share price IRR can be calculated with the following formula: Earnings CAGR x Multiple CAGR x Share Count CAGR.4 Earnings itself is a product of Revenue CAGR and Earnings Margin.

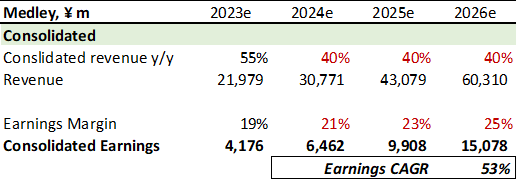

Regarding revenue – In a three-year period, Medley is highly likely to grow its revenues in excess of 40% per year. Given this, we can estimate Medley’s FY’26 revenue to be somewhere in the range of ~¥60 billion, up from ~¥21 billion in FY’23.

Regarding earnings – Medley is currently achieving 19% earnings margins on 17% EBITDA margins. EBITDA margins are continually expanding by nearly 250-300 basis points per year while corporate overhead expenses decline as a percent of sales and while Medical PF has matured towards profitability. Therefore, If Medley were to grow its earnings margin by 200 basis points per year for the next three years, then we would get an earnings margin expands from 19% to 25%. In absolute terms, free cash flow would grow from ~¥4 billion to ~¥15 billion. Profits will have therefore grown by 361% in three years, a 53% compounded annual growth rate. So the first part of our equation is complete.

Regarding multiples – Medley’s current multiple of 33x earnings will almost certainly decline over time. I have been unable to find reliable data showing the average historical price to free cash flow for an index over a multi-decade sample period, but MacroTrends reveals that the average Price to Free Cash Flow Ratio for the S&P Global Index from 2010-2021 was approximately 25x.5 It is safe to say that Medley is going to grow its earnings well in excess of the average constituent of this index. But for our purposes, let’s estimate Medley’s multiple of earnings contracts to 25x from 33x. This then would produce a 3-year multiple CAGR of -8%.

Regarding share count – Medley’s share count has been diluted by ~0.5% per year. We shall assume a 1% dilution rate per year going forward.

Our equation is ready to run: Earnings CAGR of 53%. Multiple CAGR of -9%. Share count CAGR of -1%.

1.53 x 0.92 x 0.99 = 39%

We can anticipate a 39% annual growth rate in our shares of Medley if, in three years, revenue has grown by 40%, earnings margin has expanded from 19% to 25%, and multiples of earnings have contracted from 33x to 25x. This is an extremely high rate of return, so next, let’s examine the sensitivity of this estimate.

The below table looks at the revenue that could be anticipated in FY’26 at various revenue growth rates.

Medley is guiding for a 30% 7-Year CAGR from FY2023-2030, so I don’t find it to be outside of the realm of rationality to include a 40% or 50% CAGR over a 3-year period from FY2023-2026.

We may then examine a range of earnings margins that might be achievable.

A 19% earnings margin three years from now will be a supreme disappointment considering that this is Medley’s current earnings margin and that there have been sequential increases in the margin in the years prior to today and the management team is guiding for further improvement in profit margins. Meanwhile, a 29% profit margin is pushing the upper boundary of what might be achievable within three years.

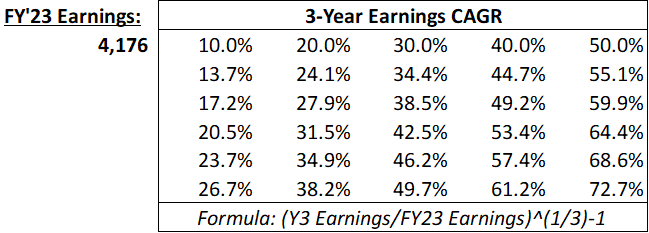

Next, we can look at the earnings CAGR based on 2023’s earnings estimate of ~¥4 billion.

Finally, we can multiply these earnings CAGRs by a range of multiples of earnings; 15x, 20x and 25x. Please take a moment to examine the calculations below.

If you consider the far-left column (10% Rev CAGR) and the far-right column (50% Rev CAGR) to be least-likely to occur (as I do), and the top-most row (19% earnings margin) and the bottom-most row (29% earnings margin) to be similarly unlikely, then you can narrow your attention on the most-likely outcomes.

Within this narrowed focus, the worst probable outcome (20% Rev. CAGR; 21% margin; 15x multiple) is a negative 5.6% per-share CAGR while the best probable outcome (40% Rev. CAGR; 27% margin; 25x multiple) is a 43.5% per-share CAGR. Importantly, these are not symmetric upside-downside scenarios, nor are they equally probable.

I believe it to be highly likely that Medley grows its revenues in excess of 40% for the next three years, and I similarly view it as highly likely that the company flexes further profit margin improvements. Inversely, I view it to be highly improbable for revenue growth to be below 30% for the next three years and for profit margins to cease their continued upward movement.

The distribution of expected returns is therefore asymmetrically favorable.

Revenue Quality

One final point that I would like to make is one of revenue quality. The demand for Medley’s services is incredibly stable. Like clockwork, approximately 15% of the Japanese healthcare workforce will transition jobs in the coming years irrespective of where Japan is at in its capital market cycle. Medley is both the cheapest and the most convenient solution by a long-shot and appears to be structurally positioned to gobble up market share from its inferior substitute for a very long time period. Similarly, the Medical PF business is selling extremely sticky software products that will never not be mission critical. The cost advantages of these tools, coupled with the push from the Japanese government for all health clinics to modernize, creates a unique catalyst for a decade-long growth runway that Medley is extraordinarily well positioned within.

Conclusion

If the above thesis is true, as I believe it to be after completing extensive research, and Medley operates with compelling value propositions and competitive advantages in both of its business segments which are each deeply underpenetrated, then it stands to reason that Medley will continue to experience success at a high-rate of growth. The demonstrated capital discipline displayed by Medley’s management team, makes it similarly likely that margins will continue to expand, and that any future acquisitions will be accretive to shareholder value in excess of the above estimates.

Jake Barfield is the founder of Asheville Capital Management, LLC. Asheville Capital focuses on investing in a concentrated basket of world-class businesses before they are broadly appreciated as such.

Jake can be reached at jake@ashevillecapitalmanagement.com.

Interestingly, despite this lower average placement fee, Medley captures 45% EBITDA margins, which are well in excess of SMS’ 15% margins. This is due to the fact that SMS’ intermediated approach is labor-intensive while Medley’s requires minimal labor and is asset-light.

If the market size remains static over that time period.

When I refer to “earnings”, I am referring to operating cash flows less normalized capital expenditures and stock-based compensation (SBC). Otherwise referred to as Owner’s Earnings. Fortunately, Medley pays very little in capital expenditures and treats SBC as a true cash expense, buying treasury shares on the open market from its own balance sheet to meet its obligations, and so therefore it can be said that, in Medley’s case: free cash flow ≈ earnings.

Hi Jake, thanks for such a thoughtful writeup!

Curious regarding some aspects:

- Why do they separate out additional corporate expenses outside of segmental ebitda? Try to understand the large increases in this uncharacterized corporate expense.

- Seems like while HR PF seems to be a the dominant product in its niche (excluding Hello Work), however the medical PF seems to be underpenetrated? I might be incorrect, but cannot seem to find info on their marketshare or churn rate. I assume their offering should have very low churn but surprised to see it not on the IR presentation deck.

- I would have imagined the CEO focus to be 100% on growing medical PF and they are communicating that is the case in 2025. But still trying to understand rational for insisting on USA business.

appreciate any insights. thank you!

Hi Jake, great write up. Do you have a view on how they would verify employment if the 10K yen or whatever bonus that they pay 60 days post employment is prohibited? How many employees they would have to hire and how much price would have to go up to protect absolute profits? seems even if it 300-400 people at 7M yen pa, which seems aggressive, they only need to increase price by less than 20% on 140K avg per placement, which would still keep them very competitive? Also do you know what is the "settlement" non operating income they are getting, how long its going to last, and how to model it out? thank you!