Timee Investment Thesis

Timee is Japan's leading spot-work marketplace, with dominant market share in a fast-growing industry likely to compound earnings at a high rate for the next several years.

The following is an excerpt from Asheville Capital’s 2025 Interim Letter to Partners, in which I detailed our reasons for initiating a position in Timee in Q2 of this year. It is not investment advice.

We initiated a new position in Timee during the second quarter at a cost basis of ¥1,750 per share. Despite the recent price appreciation to ¥2,246 per share today, I believe it to be an attractive long-term investment opportunity in a strong, competitively advantaged business that has only begun to tap into its addressable market.

Timee is a Japan-based marketplace for on-demand labor, which is otherwise known as “spot work”. Think of it as an Uber for part-time work. The marketplace connects individuals who want flexible, shift-based jobs with employers who need short-term help across industries like logistics, food service, and retail.

The company was founded in 2018 by Ryo Ogawa, who, as a college student, encountered the typical frictions of Japan’s part-time labor market: a cumbersome application process, rigid scheduling, and delayed payments. These inconveniences were disproportionate to the simplicity and short duration of the work itself. Timee was created to remove these frictions, offering a more flexible and immediate solution for both workers and employers.

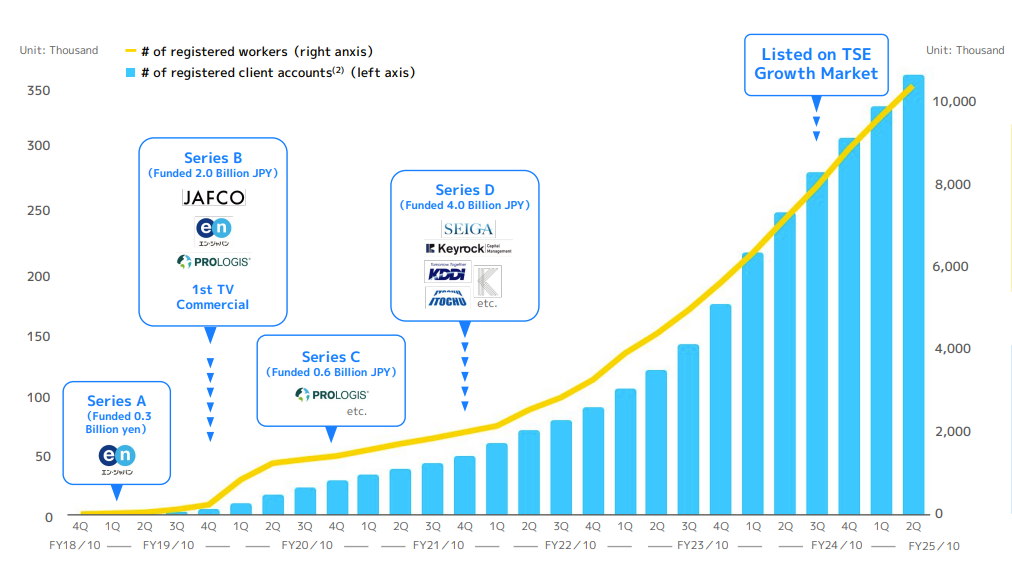

This year, just seven years after its founding, Timee will facilitate more than ¥115 billion (~$800 million) of total transaction value and generate ¥35 billion (~$240 million) of revenue at a 95% gross margin and an 18-20% operating margin. Timee has more than 11 million registered workers (out of a working population of 75 million) and 350,000 registered employers.

Having essentially invented the industry, Timee parlayed its first mover advantage into obtaining quite strong network effects. Today there are several sub-scale competitors that have entered the market, yet Timee remains the overwhelming market share leader with more than 10x the number of job postings than the next-closest competitor. Furthermore, Timee boasts an 88% job fill rate, which significantly exceeds that of its competition (which is estimated to be 40-50%).

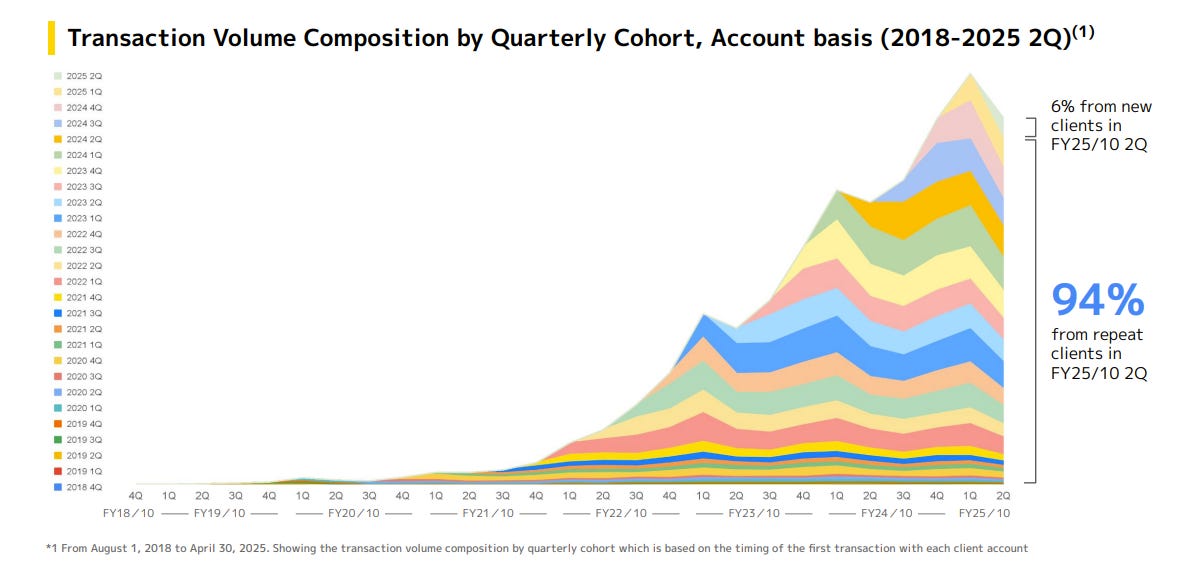

The differential in fill rates creates a powerful feedback loop: employers continue to stick with what works, and workers follow the demand. This has translated into a sticky, recurring business – 94% of Timee’s transaction volume comes from repeat clients and 92% of jobs are filled by returning workers. Moreover, employers tend to use only one marketplace at a time (instead of using multiple solutions) because of the inherent risk of overbooking staff and also because there is a labor law risk to employers in using multiple platforms.1

Despite its progress, Timee’s revenue penetration within its three core verticals remains miniscule at around 2%, with the majority of the remaining market still served by traditional temp agencies that are slower, more costly, and less reliable. Within the broader on-demand labor category, however, Timee holds an estimated 75% share, facilitating ¥90.8 billion of transaction volume in 2024 out of a total market size of ¥121.6 billion. That market has more than tripled over the past two years yet still represents just 0.11% of total working hours nationwide and 0.7% of hours worked by part-time and temporary labor. Even in the industries where spot work is most concentrated (logistics, food service, and retail), it accounts for only 6.9%, 3.2%, and 0.8% of working hours, respectively. In short, Timee is the clear leader in a small but fast-growing category; one that remains meaningfully underpenetrated relative to the broader labor market.

Timee is growing revenue (+30% in FY25E) and operating profit (+49%) at impressive rates, and it's doing so with remarkable capital efficiency. The company has raised just ¥7.2 billion in outside capital since inception yet is expected to generate ¥6.4 billion of operating profit this year alone, at an 18-20% margin. I believe those margins will continue to expand with scale, potentially into the 30– 40% range over time.

At a ¥200 billion market cap, we’re paying ~30x this year’s operating profit. That may appear rich on the surface, but Timee is still early in its market penetration, operates with a capital-light model, and is showing continued margin improvement. A five-year, 15% revenue CAGR seems plausible, if not conservative. With high repeat usage rates among existing customers, much of that growth could come without significant incremental spend, which would therefore allow earnings to grow at a faster rate than revenue.

Timee checks many of the same boxes that have drawn us to our high-conviction holdings: a strong value proposition, structural advantages, inbound operating leverage, and unusually high returns on incremental capital. I have initiated a small position while trimming our stake in Medley, not out of diminished conviction, but because the two businesses share exposure to the same structural labor dynamics in Japan. I view Timee and Medley as a pair trade on one of the country’s most pressing demographic realities: a shrinking labor force that is increasingly turning to technology to bridge the gap.

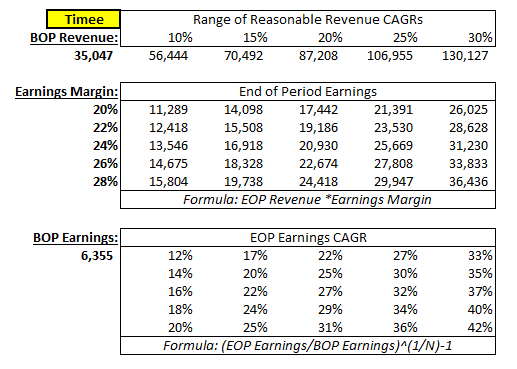

Timee Five-Year Estimates

Timee’s management team does not provide mid-term guidance so we are left in the dark a little bit when making forward estimates. I have therefore built out a sensitivity table based on a range of five-year revenue growth rates, operating profit margins, and operating profit multiples, that I believe to be reasonable. We could make this much more detailed with a variety of KPIs but in the interest of keeping it simple, I opted to limit the assumptions to these three variables.

For the years following FY25 through FY2030, I believe that the following range of revenue CAGRs and earnings margins are most likely. Starting with FY25E revenue of ¥35 billion and growing at a five-year CAGR of between 10% to 30% gets Timee to between ¥56 billion and ¥130 billion of revenue in 2030. A wide range of potential outcomes, but one that we must take into consideration to account for significant growth trajectory uncertainty. For what it’s worth, I believe a 20-25% revenue CAGR is most probable.

Moving on to operating profit margin. Management estimates its long-term operating margin to be in the 30-40% range, up from ~18% expected in 2025. I estimate a five-year margin range between 20- 28%. This gets them to operating profit estimates between ¥11 billion (in the event of a 20% margin on a 10% revenue CAGR) and ¥36 billion (in the event of a 28% margin on a 30% revenue CAGR).

Moving on to multiples. Assuming three scenarios – 15x, 20x and 25x operating profit, a decline from our cost basis at ~27x NTM operating profits, and from ~30x, where it trades today. The worst scenario, under these assumptions, results in a -2% per-share annualized rate of return (assuming a 15x earnings multiple on a 10% revenue CAGR at 20% operating profit margins, while the best-case scenario results in a 38% per-share annualized rate of return (assuming a 25x multiple on a 30% revenue CAGR and 28% operating profit margins).

Based on this wide range of estimates it can therefore be said that there is a negatively skewed expected return outcome. In other words, a positive and high annualized rate of return is likely with the majority of return outcomes being 18% per year or higher.

I believe the most probable scenarios are a 20-25% revenue CAGR and a 24-26% operating profit margin, which would result in an annualized rate of return between 11% to 31% depending on the multiple of earnings at the end of the period.

While I include a 10-15% revenue CAGR in these estimates, I believe them to be the most improbable outcome, given the aforementioned competitive advantages that Timee operates with coupled with the fact that they have only achieved 0.7% of hours worked by part-time and temporary labor in Japan. For context, should Timee achieve a 30% revenue CAGR over the next five years, the company still would have only gained 2.6% market penetration of part-time working hours.

Given this underpenetration with a superior value proposition and seemingly defensible competitive advantages, I believe Timee could be a decade-plus long position in which the business itself is much larger and stronger ten years from now than it is today. If these qualitative characteristics remain in place and the management team remains disciplined in their capital allocation, I am hopeful that we will continue to be shareholders.

Jake Barfield is the founder of Asheville Capital Management, LLC. Asheville Capital focuses on investing in a concentrated basket of world-class businesses before they are broadly appreciated as such.

Jake can be reached at jake@ashevillecapitalmanagement.com.

Regarding labor law risk, when one worker gets paid above 88,000 yen (~$600) a month at one location, the employer becomes responsible for that employee’s social insurance. When an employer uses multiple platforms (i.e. Timee, Mercari, Shareful, and others) they are unable to accurately track how much workers earn. This is another strong incentive for employers to use only one platform.

Hello, just a question about this company. I see a lot of stock options in the short term and, to my knowledge, no explicit rules for these stock options in the future to include them in the valuation. Perhaps I have a very pessimistic view of this risk. How do you personally assess this risk for this company?

Any opinion/comment on the ~-20% move since earnings? Thesis intact, or time to panic with the slowing profit and food industry?